Originally appeared in MarketWatch’s Retirement Weekly.

In the AMC smash-hit television drama “The Walking Dead,” a group of road-hardened survivors of a zombie apocalypse seek protection from the undead (and the living who pose greater dangers than cannibalistic walking corpses.)

The fifth-season opener finds the weary characters fighting for their lives against a community of cannibals who lured them to a so-called safe zone called “Terminus.”

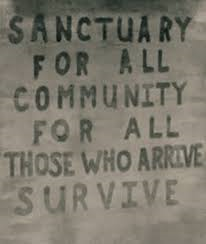

Handwritten signs and maps along roads and rails of rural Georgia guided the crew to a final destination, sanctuary was promised for all who arrived.

On the surface, it appeared to be a dream come true. Warm smiles, comforting words, hot food.

Underneath, Terminus was nothing as promised or perceived. Victims were lured in to be placed in rail cars like cattle and eventually slaughtered.

As there is a fine line between fact and fiction, this harrowing situation got me thinking about portfolios in retirement.

Stay with me.

Think sanctuary and think safety. A false tranquility can disarm and open the gates to great risks without your awareness. What lurks underneath your financial safe havens may eventually place your money and retirement lifestyle in jeopardy.

When making financial decisions and monitoring progress based on those decisions, you need to accept when the environment changes; make a move when safe havens turn to Terminus.

Here are five financial sanctuaries that can place a secure retirement at risk right now.

Random Thoughts:

1). Stocks. Market sanctuaries can turn unrecognizable and hostile very fast. As the stock market reaches new highs there’s an ominous feeling of complacency among investors. It’s been over three years since the S&P 500 hit an official correction or greater than a 10% drop from a previous closing high.

Consider October’s volatility a wake-up call as early in the month, the S&P 500 was rapidly moving into correction, small-company stocks and international stocks were officially there and bond yields moved lower (100% of economists predicted that bond yields would be higher by fourth quarter 2014). October concluded much different than it started – with domestic markets headed to new highs.

Underneath the surface of stocks it looks nothing like a sanctuary – Large and mega-cap indexes have outperformed, a sign of a late-stage bull market phase, small-company stocks are recovering but underperforming, which points to risk abatement. It shouldn’t be ignored how cyclical stocks like energy, or those considered beneficiaries of economic expansion, are lagging defensive stocks (think utilities, consumer staples), currently. The outperformance in defensive sectors is usually indicative of market tops and economic peaks.

The Federal Reserve’s conclusion of quantitative easing (bond purchase) program in October signifies a reduction of central bank liquidity that can increase volatility as investors and traders seek to figure out what the next tailwind for stocks is going to be.

The S&P 500 is 24.5% above its three-year moving average (36 months) -one of the widest dispersions from the moving average since fourth quarter 2007. Like a rubber band, over time market returns will stretch far above and below long-term moving averages. Although it’s impossible to know when the band will snap back to the moving average, historical downside going back to 2000 shows when the market does contract, the process is damaging. The worst contractions were 38% and 40% in 2002 and 2009, respectively.

Stocks are protection against inflation until they’re not and you’ve lost 5 years making back what you lost and inflation becomes the least of your problems. By then, you’ll feel trapped and look to re-pave the path of retirement. Whether it’s returning to work, reducing household expenses, cutting how much you withdraw from investment accounts – you’ll be prepared to do whatever’s necessary to preserve capital and slow the bleeding of investment assets.

Create an allocation to stocks that won’t cause you to panic when the bear market arrives (and it will). Don’t be overconfident. Remain vigilant and make sure to follow rules-based rebalancing where you trim gains on a periodic basis. The fourth quarter of the year is a good time to tax harvest – sell positions with capital losses in brokerage accounts to offset capital gains.

2). Index funds. It appears that index fund enthusiasts will stand strong and proudly absorb the blow as their stock sanctuary turns against them. Indexers believe that losses are temporary because in the long-term, stock markets always recover; paper losses aren’t real, they’re perceived as a bump along the path, par for the course. Like the befallen travelers who arrive at Terminus, they are not in touch with the reality of the situation they’re up against.

A sequence of anemic returns or losses in the face of periodic withdrawals can dramatically decrease the longevity of a retirement portfolio. In other words, index funds are no protection against increased drawdown and market risks. At least fees make the losses less painful (or do they?).

The battle among “passive” indexers and “active” fund advocates is growing more heated as the fourth longest bull market in history continues. I consider most of the discussion noise; the headlines are a distraction from the real perspective investors in retirement should maintain:

No matter what you hear out of most financial professionals, stock index funds are not passive. Every investment should be treated as active as soon as it is added to a portfolio.

Look beyond the attributes of stock index funds (and there are quite a few) like low fees, wide industry and company representation, tax efficiencies, and face the traps that will eventually put you in a position to fight or perish.

For example, index funds will experience the full brunt of a bear market attack (because generally they represent the market) which means you as the manager must decide the degree of loss you’re willing to accept. Staying invested is an action; reducing exposure to a losing index investment is an active decision. You are always in control, you always have a choice.

The preachers of passive seem willing to stand by and hope for the best. After all, you can’t control or predict the direction markets. That’s true. However, the amount of capital destruction you’re willing to absorb, is in your control. Consider the potential damage and recovery rate. Your back is against the wall. Are you ready to fight? If your portfolio suffers a 20% drawdown you’ll require 33.33% to break even.

Specific purchase and sell rules must be attached to each investment under consideration. Risk management never ensures against all portfolio losses, it minimizes the damage so you can come back and fight another day. It’s all about survival when it comes to the end of world (and your money).

Also, when you invest, depending on stock market valuations, is extremely relevant to future returns.

According to market historian and writer Doug Short, $1,000 invested at the peak of the market in the S&P 500 on March 24, 2000 would be worth $1,248 (adjusted for inflation) as of November 2, 2014, which equates to a 1.53% annualized real return.

Despite the mainstream marketing message (especially among indexers) designed to convince you that “time in the market” is a sanctuary, there have been many periods in history where you simply “ran out of time.” When adjusted for inflation, there are several 20-year periods in history where market returns have resulted in either low or negative outcomes.

Index funds have most likely outperformed your managed investments on the upside during this bull market; that doesn’t mean they’ll hold up better through market declines. And when you buy, based on market price/earnings, has a significant impact on future returns. At nearly 26 times earnings based on the cyclically-adjusted P/E ratio, “time in the market” may not be as beneficial over the next 20-years. It just may be a Terminus for your portfolio.

3). Retirement account withdrawals. The 4% withdrawal strategy is too generic to be effective yet it’s treated like a universal rule and preached in mass to new retirees seeking comfort after a long journey of employment. It’s as worn as the warped, wooden signs guiding The Walking Dead survivors to a place they perceive as refuge, but really is a trap.

Based on work by Sam Pittman Ph.D. and Rod Greenshields, CFA of Russell Investments, the first step to creating a retirement withdrawal that protects against longevity risk, is to calculate the ratio of current assets to the present value of forecasted retirement spending. This is called your current funded ratio. It’s a popular method pension administrators use to determine the fiscal health of their expected payouts for participants. Few advisers will consider this method and go straight to a withdrawal rate calculation that doesn’t account for an individual’s overall financial situation or household balance sheet.

The current-funded ratio method requires matching assets to liabilities to determine whether there’s adequate coverage over living expenses and inflation throughout retirement. A ratio of 100% or greater, especially during the first decade of retirement, is indicative of a greater chance of avoiding outliving a nest egg. If the present-value funded ratio is estimated to be less than 100% in ten years, adjustments to withdrawal rates or living expenses can be made before withdrawals occur. The ratio should be calculated every three years or after a sequence of below-average portfolio returns.

The strategy is called adaptive investing. Ask your financial partner about it to see if makes sense as part of your retirement planning process.

4). Company stock concentration at the beginning of retirement. Many retirees are hesitant to manage their net worth tied up in company stock, especially in the early years of retirement. Their human capital may have left the company and enjoyed the retirement party but the emotional attachment to the stock continues strong, and is possibly dangerous.

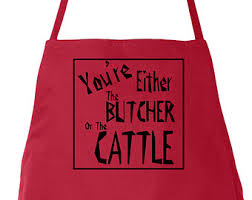

More than 25% of liquid net worth in company stock, leaves a retiree either “the butcher or the cattle,” a philosophy the tenured residents of Terminus believe. It’s a great tailwind to net worth and retiree psychology when an overconcentration to company stock is performing well hence the butcher. When the investment is performing poorly, a vulnerability to the retirement plan arises which becomes an emotional and financial drain to the retiree and others in the household.

A formal plan should include an exit strategy for company stock within 5 years of retirement. Work down to a 10% allocation which will satisfy your attachment need but won’t derail the early years of retirement. In addition, it can allow you greater diversification potential and liquidity to meet living expenses.

5). Your broker. Someone asked me once – “Are you a broker?” I replied – “No. I’m not here to break anything, I’m here to help.” Joking aside, you may be very comfortable with your current financial relationship; consider if you have an understanding of the motives behind your adviser’s employer. Perhaps you never gave it a thought.

Ask this question: “What is your sales goal and how do I fit in?”

Yes, most in the financial services business are salespeople. Nothing wrong with it as long as your needs are met and full disclosures are made. However, maybe you’re looking for something more. I believe this question gets to the heart of a financial firm’s true motivation. Then ask: “How do you feel about your sales goals?” Are they perceived as fair by your financial partner? Ask another: “How much time will you spend with me, my planning needs and investment accounts?”

Get specifics. Ponder the answers, then consider: Are you a one-time sale or an ongoing relationship, or a bit of both?

In a recent podcast interview with self-help author and investor James Altucher, success coach Anthony Robbins shared candid insights from the experiences writing his new book, “MONEY Master the Game: 7 Simple Steps to Financial Freedom.” He explains how the financial system is designed to prosper the needs of shareholders, not investors. My take: A key is to know what questions to ask and seek answers that are simple and transparent.

“There are 312 names for brokers, today,” Tony mentions. “I’m so supportive of people that are fiduciaries, people that are trained and who are legally required to look out for you. I’m looking for people who are fiduciaries and sophisticated.”

I believe disclosure of sales goals is important. Understanding if your adviser is a fiduciary and focuses on your interests first, or a broker that has his or her employer’s objectives as a primary focus, will help you find the right long-term partner or clarify a relationship you currently enjoy (or question).

The investing climate for retirees can be scarier than fleeing from flesh-eating zombies.

Even worse are times you believe you’re safe; conditions change, you fail to acknowledge the shifting environment or realize that a financial sanctuary has turned hostile.

It’s always better to be the butcher than the cattle.

Perhaps that fiendish Terminus crew were on to something after all.