Zombies have been taking over your city whether you realize it or not.

It’s been happening for decades.

Good enough reason to keep your doors locked, people! Not that locked doors help for long. After all, a mere few zombies can turn over cars so bolted doors and measly plywood over windows buys you just enough time to say goodbye to the loved ones.

Sooner or later you’re on the menu.

Zombies are so white-red hot right now; these decaying, staggering masses or the deadest of “us,” easily steal attention away from popular (yet horrific) headlines from the likes of a very living Kim Kardashian stripping down or Lindsay Lohan losing her top at a nightclub. Who wants to see a naked zombie exposing her breasts (except out of macabre curiosity?)

Well, I do! But that’s just me.

The living dead have risen in prominence. Taken their rightful place. Gnawed their way to the top.

For decades their popularity has ebbed and flowed yet their presence has never truly decayed. And now they’re everywhere you turn. It’s the zombie time to shine! Albeit they’ve lost a healthy glow shared by their breathing cousins but it doesn’t matter.

I don’t see zombie popularity diminishing in the near future.

As economic conditions remain strained and public unrest persists, the fascination with these rotted maggot shells lives on. Several investigations exist to prove my case. I won’t bore you with them.

I’ll share my own rationale behind zombie fever. Also why I’m scared of them and admire them at the same time.

First, think about this:

They don’t fret over paying electric bills, meeting mortgage payments or college tuition

costs. The days of anguish over the daily money monkeyshines of the living are gone! Surviving takes on a totally different perspective.

How we relish those with reckless abandon who can just chase and bite, stagger and gnash like rabid animals.

The Government has even been known to send dead people unemployment and social

security checks but they have no need to cash them. I’m jealous. The mortal coil

of everyday fiscal obligations is broken. We are envious of the financial freedom. Who

wouldn’t be?

Zombies are brazenly wasteful and they don’t care!

It gets me frustrated. If the living dead are so ravenous why do they take no more than two bites of prey and move on? There isn’t an endless supply of warm bodies to nosh on.

The undead need to do better with food handling. What about all those starving zombies in China? Even when they decide to dig hard and tear deep through a victim zombies don’t appear to be eating. They play with their food (in this case elbow deep in intestines, organs and other nondescript red slimy entrails). If I enjoyed my food this much as a kid I would have been in enormous trouble with the parents.

Perhaps I’m missing the point.

Maybe zombies don’t require sustenance. Now that I ponder, why would an animated rotting corpse need nutrition? Could it be they bite primarily to propagate the undead population?

They don’t appear to be very friendly to each other. I don’t witness any bonding among zombie hoards that convinces me they derive any benefits from increasing the undead population through procreation. I witness no hand holding or team work. They don’t even trip over each other.

Zombie French kissing seems wrong, too. Some don’t have tongues.

In the AMC hit television series “The Walking Dead,” a believable explanation for the

genesis of said program title emerges.

At least it allays some of my frustrations over the deliberate waste of the fresh walking food supply.

In the Season One finale “TS-19,” the sole remaining doctor at the Center for Disease

Control (gingerly insane although very sage from a lethal combination of: Isolation, shooting his wife known as test-subject 19, and acceding to the awful truth

that there is no cure for the afflicted), outlines findings as a zombie zealot, I find plausible.

Dr. Jennings explains:

“The disease invades the brain like meningitis (ok I heard that’s bad).

The brain stem is restarted. Gets them up and moving (makes sense to me).

Most of the brain is dark: Dark, lifeless, dead. The frontal lobe, the “you,” the human part

is gone (it does appear that way).”

I’ve concluded (I think), animated dead folk are indeed ravenous.

They don’t possess the human or humanity (what’s left is a tiny spark of light at the base of the brain) to make the most of preserving the food source.

Dr. Steven Schlozman, a psychiatrist, Assistant Professor at Harvard Medical School and author of the book “The Zombie Autopsies,” would agree with Dr. Jenner’s conclusions and sizes up zombie appetites in a further professional manner perhaps because he never lost a loved one to a zombie nibble:

“The ventromedial hypothalamus (in the brain), which tells humans whether they’ve had enough to eat, is likely to be on the fritz in zombies, who have an insatiable appetite.”

I sort of admire how “walkers” (what zombies are called on “The Walking Dead,”) can be wasteful (and eat whomever they want) without any repercussions. No weight gain.

Damn them. Damn them all even more than they’re already damned. Jealous.

Zombies don’t need to exercise and it’s inevitable they’re going to lose weight without

much effort. I so hate them for this. As a matter of fact even though Hollywood never

seems to get it, if survivors can wait long enough, hunker down. The dead are literally going to rot.

It’s not like they’re embalmed or preserved. They’re sauntering about through

the harshest of elements. Eventually they’ll be dragging around close to the ground. Clumps of harmless, fermented flesh if you’re patient enough. You can then brazenly walk up and do a step and squash on what’s left of a head. Simple.

My boots are ready!

Zombies don’t poop. They’re no longer human, therefore they can’t blow up the economy, housing, stocks, banks,the currency, gold, or whatever else financially related. It would be a relief not to be bothered with reading all the financial publications that consume me.

Since zombies don’t experience fear, avarice, lust and all other very human vices I can’t foresee how they could fuck up the economy any worse than we can. My belief is corporate America is ingenious enough to eventually replace living employees with the undead at a moment’s notice.

They don’t require wages, benefits, time with family or friends.

Can you see the writing on the wall here?

Zombies no longer feel torment, guilt, revenge, passion, regret. They don’t hold baggage from parents who messed with their heads.

No cheating spouses or backstabbing friends to fret over. No Viagra (they’re stiff enough). No looking to slice up the boss (unless it’s for the purposes of eating.) Bliss!

Zombies can’t run no matter how some movies mess this up. I have a major issue with this one and I’ve studied zombies since I was ten years-old. This is purely an exploitation move created by film makers to make audiences feel more vulnerable and scared. No thank you. I’m scared enough by the staggering, original kind.

Dr. Schlozman would back me up big time here. The good doctor in his book takes his

zombies seriously. As a matter of fact, when the zombie apocalypse finally arrives, survivors must find a way to the doc. His extensive study will be invaluable.

These primal hollows of our living selves just cannot run. Done.

From Doc Schlozman’s “The Zombie Autopsies,” the wisdom flows freely like blood from a gaping bite wound:

“Slower degenerative processes in the cerebellum explain the initially intact gait of the

infected, even though they all become increasingly unbalanced with time.

That’s why they hold their arms out in front of their bodies: for balance and increased coordination.

They just want to remain upright, on their feet. But the process continues, the cerebellum degrades, liquefies. Virtually all late-stage ANSD humanoids ambulate via crawling.”

AH-HA!

See? Running zombies are an abomination! Listen up movie-makers! I prefer my zombies slow, staggering and overwhelmingly off kilter. I’m a purist.

FYI – ANSD stands for: Ataxie Neurodegenerative Satiety Deficiency Syndrome. The

internationally accepted diagnostic term for zombiism. Thanks again Dr. S.

Zombies should stink to high heaven so why don’t victims smell them coming from at least

half a mile away?

I once went an entire week without bathing in 1989.

That’s after sex with two different women, eating several boxes of Entenmann’s orange-swirled chocolate Halloween cupcakes, ten Big Macs and washing it all down with large cups of coffee laced with heavy cream.

I recall plenty of female nose crinkling and waves of disgust. Good thing I didn’t leave the house.

You rarely see disgusted looks on the faces of the living. I never heard once in a zombie movie.

“I can’t handle the smell of these walking maggot bags.”

“My eyes are watering from the stench of these fuckers.”

“I’m going to vomit from the ungodly odors these dead things throw off.”

Well, to pay homage to the terrific writers of “The Walking Dead,” like Nichole Beattie (who also has great hair that frames a perfect brain) there have been various references to puke, puking and zombie dead-body odor peppered throughout episodes.They’re passionate about authenticity unlike most who cater to us zombie zealots.

I salute them.

I passionately believe my teachers and friends – The Altuchers (James, Claudia), Kamal Ravikant, Srini Rao, prosper from personal tribulation and help alleviate the suffering of others.

I wondered: Can these sages learn from the behavior of the undead? I believe so.

The dead providing life lessons sounds strange, but I’ve been humbled by the dead. Their teachings sit deep in my frontal lobe.

In many ways, those who have passed are by my side more than ever. They might as well be walking alongside me in following dark shadows.

I’ve learned a valuable lesson over the last two years as I’ve studied zombies:

Hey asshole: Get out of the grave you’re still alive!!

What caused me to living die? What causes you to living-die every day?

Working for corporate America (I affectionately call “Corpse America”) was a living death. Every day the corporate overseers would concoct creative ways to squash my spirit. I was under the cancerous thumb of a bloated financial services firm that lost its ethics and I was rotting away. Fast.

There was less time being productive and more mental resources wasted on complying with draconian-like rules and impossible sales goals that were progressively getting worse.

I felt powerless, sick, listless, diseased. I was passively allowing my brain to go dark.

I was able to fight off the corporate infection for years. Then I couldn’t battle any longer.

My immunity for bullshit broke down. I gave zombie-ism permission to wash (bleed) over me. Limbs went limp. The stamina and passion for my business was draining fast like black blood from a gaping neck wound.

I loved the clients and co-workers but felt truly powerless over my destiny. I was bleeding respect for myself and for the first time in years, the confidence in my skills was drained. I was frightened all the time and the dead were closing in on my space.

No matter how much wood I nailed over the windows they just. Kept. Coming.

Was I the only one who felt like this? I don’t know. I could see the light fade

from the eyes around me. Others were going to allow their souls to flee the mortal cavity.

There were the kids, or the mortgage, the car payment or the necessary financial

support for the stay-at-home spouse. Everyone was overextended.

Surrender felt like the only option. It was like exposing your most important parts willingly to a nasty zombie bite.

Ongoing bad health habits sooner or later, are a coffin filler.

In 2006, my idea of diet rarely strayed from a cheeseburger with a side order of donuts followed by another cheeseburger and six more donuts.

That was 50 pounds ago. I managed to do enough damage to my organs in one year to end up with Type 2 diabetes, high blood pressure and cholesterol level approaching 280.

I was so out of shape even a zombie-like stagger would have put me out of breath. Having diabetes scared the zombie out of me. The thought of going blind or losing a limb was more than I could live with. Dead man walking (on one leg) was not going to happen!

I changed overnight. Oh I’m not perfect, but the disease was a blessing in disguise. I needed something frightening to jump start me.

It worked.

Think about it: What will jump start you to take your health seriously before it’s too late?

Big debt is a flesh biter. Excessive debt levels are a lethal weight on your shoulders and will suck the living life (and death) from you. Whether it’s your household or a government, too much debt is a brain drainer. Oh, you’ll still be able to walk around but dead inside you will be.

It’s worse for your situation than for most governments since you can’t create your

own money (well legally anyway). Too much debt in any form will have you unbalanced

and rotting in no time.

Media overindulgence, especially television, zombifies the frontal lobe. I hate to feel this

way since I know so many terrific media people. It’s just that television especially pseudoreality (not real reality because who wants to watch that?) campy talent and political drivel all eventually erodes the stuff that makes you “you.”

Just monitor and limit your intake.

Writing and reading for at least an hour a day keeps my frontal lobe in a less gelatinous

state. Find what works for you. Even playing a board game might help. Not

Sudoku. I’m convinced zombies created that game. Sudoku players fill out every Sudoku puzzle in every magazine at every doctor and dentist office. It spreads like

chicken pox. Stay away!

Syble Solomon, creator of Money Habitudes™ writes about how the television virus

attacks and tempts you to spend money:

“More subtle are the images of what is

“normal” that are created in most television

shows and movies. Usually people

are well dressed, have great accessories,

drive nice cars and live in up-scale comfortable

housing with expensive furniture and beautiful kitchens. You rarely see anyone

paying for anything on TV or in the movies.”

You ever see that fancy apartment on the TV show “Friends?” How did those losers afford it? You begin to believe that’s normal! It’s NOT. Unless the women were high-end call girls working overtime. Then it’s a possibility.

What knowledge you can gain from the walking dead. See? There’s so much.

You’re not the shuffling soulless yet. Be thankful for that. The zombie inside captures

your glance in mirrors. It so desires to permanently deprive you of all the colors

that make you warm and human. It will win if you let it. It works to tempt you.

Even though it feels like you’re dead sometimes, of course you’re not. The nice thing is there’s a cure for your zombie transformation. You can come back.

I know how some of the stuff I wrote about earlier can fry you from deep inside – the

job, the bills, the spouse, the boss, the debt.

Then there’s the receding hairline, the erectile dysfunction. How do you handle this?

Discover ways to restore faith and revive the soul. Search out, step back and document the humans, actions, things that keep you alive and grounded.

It’s healthy to be wasteful once in a while. Put the zombies to shame.

I’m not alluding to tossing crisp, new $20 bills from the sunroof of a moving car (I

tossed a Shania Twain CD from a moving vehicle once). I’m not even referring to

willfully taking a teasing bite out of a filet and discarding the rest just for kicks.

I allocate one day a week (usually a Saturday because I’m a horrible creature of habit,)

to partake in completely wasteful (occasionally disgusting) activities and lovingly

simmer in my own juices.

I take my time closely examining the latest edition of Maxim Magazine, an occasional Playboy, Men’s Health. I eat Chinese take-out in my underwear, indulge in endless Three Stooges episodes on DVD. I strive for a zombie-like state of non-awareness. Is that a word? You get the picture (I’m sorry).

Decompression is a good thing. My theory is that naked zombies really comprehend this chilling out thing. I admire free spirits (living or living dead). Unfortunately, there’s a real scarcity of nude zombies in movies and television. It’s blatantly pitiful (NB, can you work on that?).

The undead have been stalking society long before they became mainstream. They’re

equal opportunity, infiltrate all races and cut a bloody swath across political lines.

They gain attention when economic conditions deteriorate or improvement is anemic.

They pop up during times of social unrest. Since the last recession, the most severe in

decades, zombies have been downright frenzied.

When things are good, we’re making money or generally less turmoil exists in the world, zombies are pushed aside, beaten down. Mocked. Contained.

As much as I love them because I enjoy scary thrills, I long for the days when zombies are disrespected again.

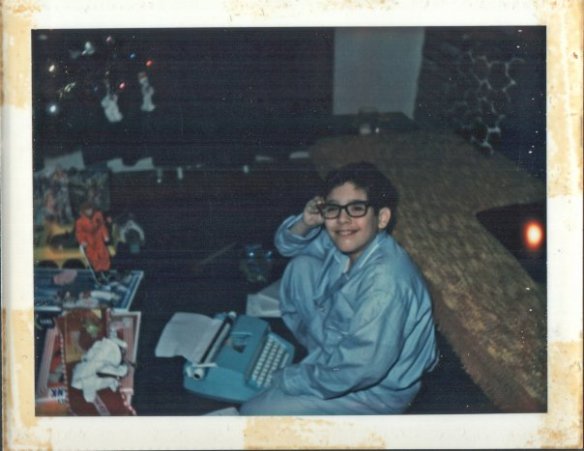

I don’t recall zombies so relevant and overwhelmingly popular as they are today; I’ve been keeping track of their ebb and flow since I first bug-eyed watched the black and white cult classic film “Night of the Living Dead,” by zombie Master Muse George A. Romero, on a crappy plastic encased thirteen-inch black and white TV. 1973.

Romero: The Zombie KING.

Romero: The Zombie KING.

In 1968, the year “Night” was released, the Vietnam War was released, the Vietnam War was raging, civil rights protests were grabbing headlines and Martin Luther King, Jr. was assassinated.

The film cost a grandiose $114,000 to make which even then for a movie was a pittance of a budget. It has grossed over $30 million worldwide. What a return on investment!

Romero created a controversial stir by featuring a black man, unknown stage

actor Duane Jones, as the brave and resourceful hero while most of the men (white) in

the cast were blowhard, wishy-washy or backwoods white folk.

Romero also plays up the contemporary theme of government distrust as dead

body brains are “activated” (allegedly) by radiation expelled from the explosion

of a space satellite, the “Venus Probe.”

Throughout the film, there are shots of military officials (actors) fleeing from television news cameras all the while denying the connection between the radiation and the returning dead who make a meal out of the living.

The bitter irony of the movie is how Ben (Duane Jones) solely survives the night of ghoul attacks by locking himself in the basement of an abandoned farm house only to be shot in the head the next morning by a white member of a sheriff’s posse as he’s mistaken for one of the remaining zombies roaming the countryside.

I remember watching. Scared to death, frozen. Shocked. I recall muttering the words:

“This really sucks.” I hated the ending but I understood the point Romero was trying to make. Well, I think I do. Back then, I interpreted the messages through my warped mental screen. I still believe my interpretation holds up.

First, why bother to survive a zombie hoard if you’re going to be shot in the head by

your own people (the living kind) anyway? What a waste.

Second, make more noise and scream actual words like the living (not guttural grunts like the dead) if you see a posse out a window! Ben, Ben, Ben. You were too quiet. I understand you just went through hell and you’re bit dazed but if it’s me I’m screaming like a sissy living, defecating human who just soiled his Fruit of the Looms!

Third, based on the social turmoil of the 60’s, I think Romero sought to use the film to

convey messages about the futility of the Vietnam War (conflict) and the tragic assassination of MLK, Jr. Go ahead fight the good fight, be honorable, stick to your convictions, but understand there is still a great risk. The hero can indeed fail or die. I hated how Romero killed off Ben at the end (I know I mentioned that, already).

Fourth, an interracial couple holed up in a farm house (even when the female is young,

blonde and completely unresponsive) doesn’t mean sex is definitely gonna happen. Huh?

Not when Ben is around! I was wondering when he was going to rip off Barbara’s (played by a very blonde actress named Judith O’Dea), clothes but all he did was comfort and protect her. Well, he did knock her out with a hit in the face but it was perfectly understandable. She was unhinged after watching her brother become zombie brunch. Like the opening of a porn flick, yet BEN stays out of trouble.

Even after she clawed at her scarf saying “it’s hot in here, hot.” NOTHING. Ben,

you helped me understand what being a gentleman really means. Can you imagine

if Romero had Ben have his way with Barbara?

Talk about controversy in 1968!

And…

Like their walking brethren, the financial decayed are here to stay!

Banks – With many banks domestic and global, systemically risk averse and making

thinner profits they seek to bleed you but instead of teeth you’re getting bitten by fees – higher checking account fees, debit card usage fees, fees to talk to a person, wire transfer fees, monthly maintenance charges.

Forget that. Fight living death by fees!

Consider switching to an online bank as long as you’re comfortable with lack of a branch location to walk into. I haven’t used a brick & mortar bank in years.Good riddance.

Check out the best online banks and checking accounts at www.nerdwallet.com.

Make sure the bank you choose is covered by FDIC and you don’t breach the coverage limit which is $250,000 per depositor.

Also, banks currently are not required to play by the rules – due to suspension of accounting rules whereby assets on the books are not priced to what the market would actually pay for them, there are banks that most likely are insolvent (or dead) yet still alive!

Plainly, if it wasn’t for the suspension of this rule called “mark to market,” poor performing banks with liabilities exceeding what assets are worth, would have been truly dead a long time ago and not still occupying a location near you.

When I was ten, mom would leave me home alone on Friday and Saturday nights until she found out my babysitter and her girlfriends were dancing naked in front of me during late-night TV’s Don Kirshner’s Rock Concert.

What did I know? I was pre-occupied with covert G.I. Joe missions. I never minded the

nude dancing. I’d glance over once in a while. It looked fun and free. I was scared to be

alone on occasion but mom needed her boy time I guess.

I owned the most extensive G.I. Joe collection in the neighborhood until my mother

made them disappear one by one. She was like a sniper/kidnapper the way she picked them off along with my other toys.

Especially cool were the Joes with fuzzy hair and beards. I never really embraced the Kung-Fu Grip line of brave soldiers for some reason.

We recently moved to a second floor apartment adjacent to a stairwell. The halls on weekend nights were lively, especially after midnight. Kids making out, the occasional marital fight spilling out, enriched with curse words bouncing off hallway walls, outright screaming.

I can still remember the first time I watched “Night of the Living Dead” on an ABC Saturday evening late show. The idea of zombies was sort of goofy to me before then. I believe I watched Scooby Doo trip one up on morning television. To me they were clunky cartoon relief. In black and white, late at night and thirsty for blood, zombies gained more of my respect. Scooby Doo was either brave or just a dumb ass.

It was that damn, dead woman at the top of the stairs. The devoured face. That eyeball staring at me, piercing me through an old RCA Television screen.

My perception of zombies had changed. Forever. They haunted me from that moment.

If I would have known how popular they were to become, I would have given up on this

money management business a long time ago. There was a fortune still yet to be made exploiting the undead.

According to the blog “24/7 Wall Street”, zombies are worth over $5 billion to the economy. Costumes, movies, novels, comic books, video games, television shows. All serious business.

From cult following to popular mainstream, the dead overpower the compensation of any cadre of top U.S. corporate CEOs who now make 400x what you do.

Oh no, I’m convinced. Zombies are here to say. Let’s review the lessons.

Random Thoughts:

1). Zombies represent our human weaknesses and loss of control over our environment. During periods of economic distress, their popularity festers. Fear of loss, lack of confidence, subpar gainful employment are prevalent today and will be as we slowly emerge from a housing, financial, credit, banking crisis atomic blast.

2). The living dead represent the vulnerability that lives deep inside our guts. It’s the human condition pushed to extremes. It’s the threat of loss. The loss of our ability to be human. A test under severe pressure. Up against the wall, you find out who you truly are. At this time, many of us feel vulnerable in our jobs, with our incomes, our relationships. In these times, zombies demand our full attention.

3). Understand what rots you. Stuck in a cubicle overseen by mindless middle management bosses, abrupt changes to your income, excessive debt, negative people, bad health choices. Hell, you think zombies are scary? Try to have an intelligent conversation with your boss. See if he or she can think independently from the infection swallowed daily from the corporate “stink” tank.

4). Political turmoil stirs the zombie hoards. Didn’t George A. Romero effectively teach us this lesson? There exists less faith in our leaders regardless of political party. Uncertainty allows the walking dead to herd, gain strength in numbers. In certain states, they may be allowed to vote. I’m not sure.

5). The economic system is still rotted and dragging dead feet. Five years after the worst financial crisis since the Great Depression, and the economy is still shuffling slow like a zombie in the August Texas sun. Below average economic growth, structural underemployment, first-time homebuyer malaise, below-average or non-existent employee wage growth, real median household income off 7% from 2008. This isn’t a healthy state of affairs, everyone. Actually, it’s fucking disappointing.

6). Corporations are now zombie factories. Especially the publicly-traded ones. Hey, as a money manager I love how corporate leaders hoard labor, work current employees to exhaustion, utilize financial alchemy like purchase back stock shares to boost earnings-per-share and stock prices. As an employee herding in a work force where labor is plentiful, where an individual can be replaced at any time by someone willing to accept half the pay, I would fight like hell to get out before the zombie infection takes me and I’m gnawing on an arm by moonlight.

7). It’s acceptable to go brain dead on a schedule. We’re an overworked society; people don’t take vacation anymore. Americans fear for their jobs when they take time away from their technology to be with their family. Set aside a few hours every week to indulge in a guilty pleasure. Hell, eat a pizza in your underwear. Drip salsa on your shirt and suck it off. Whatever.

1:00AM: The hall outside my apartment was especially loud. During commercials I checked the peephole but saw nothing. Then, from out of nowhere, it sounded like a sledgehammer at the front door:

BOOM BOOM BOOM!

I couldn’t breathe. I was paralyzed. I hit the red shag face down. I sought to go deep believing if I was part of the carpet, I couldn’t be discovered.

I belly crawled to the kitchen to knock the red Bell Telephone Trimline off the hook.

Thank god for extra-long pigtail phone cords. One tug and the receiver would be mine.

Stay calm. Hit the neat little lighted buttons for 911. Brooklyn’s Finest would arrive quickly to save me from the zombie with a weapon.

Then it stopped. As fast as it started the pounding stopped. The banging went dead. On

my television I saw hero Ben lighting a corpse on fire using a makeshift torch. Was I going to need to take notes? I could use a G.I. Joe as a torch. I bet that fuzzy hair would go up quick.

I was hesitant to call the police now. I was upright. I walked slowly back to the sofa facing the television. It was eerily quiet outside.

I crawled to the front of the apartment and looked underneath through lit-sliver between door and floor. Nobody. Nothing. No sound except for a heart pounding in my ears. I stayed pinned down. Not blinking.

And Ben died. Shot through the head. Just like that.

The next day I discovered there was an arrest close by. The ex-babysitter’s boyfriend had broken into several apartments. Items were stolen. Supposedly he was looking for a place to hide and thought he could take refuge in my apartment. He thought the babysitter still had a standing appointment with me.

That was the first and last time I was glad a young woman wasn’t around dancing naked in front of me.

That was the first and last time I was glad about a decision my mother made.

Fire the babysitter.